kentucky vehicle tax calculator

S fast and free to try and covers over 100 destinations worldwide much income tax of 275 kentucky vehicle property tax calculator. Motor Vehicle Usage Tax Section.

Car Tax By State Usa Manual Car Sales Tax Calculator

Web If you are unsure call any local car dealership and ask for the tax rate.

. This is still below the national average. On the drivers side of the dashboard viewable through the windshield in the Drivers side door jamb looks like a sticker on the front of your title. All property that is not vacant is subject to a 911 service fee of 75 for each dwelling or unit on the property.

Vehicle has salvage title on January 1 of tax year. Property taxes in Kentucky follow a one-year cycle beginning on Jan. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate.

Web Inquiries on refund status can be sent to motorvehiclerefundkygov or by calling 502-564-8180. Web Phone 502 564-4455. Your average tax rate is 1198 and your marginal tax rate is 22.

Actual amounts are subject to change based on tax rate changes. Dealership employees are more in tune to tax rates than most government officials. All rates are per 100.

A 200 fee per vehicle will be added to cover mailing costs. For Kentucky it will always be at 6. Web Beer in Kentucky is taxed at a rate of 8 cents per gallon while wine has a tax rate of 50 cents per gallon.

Web You can use our Kentucky Sales Tax Calculator to look up sales tax rates in Kentucky by address zip code. 2000 x 5 100. Multiply the vehicle price before trade-ins but after incentives by the sales tax fee.

Web Processing Fees Payment Methods. Please enter the VIN. Web A motor vehicle usage tax of six percent 6 is levied upon the retail price of vehicles registered for the first time in Kentucky.

The assessment shall be 60 of the trade-in value. Web Tax Estimator. Web In addition to state and local sales taxes there are a number of additional taxes and fees Kentucky car buyers may encounter.

Web Motor Vehicle Usage Tax Motor Vehicle Usage Tax is collected when a vehicle is transferred from one party to another. Please enter a VIN. Web Two unique aspects of kentucky vehicle property tax calculator state rate 6 of 5 taxable tax-exempt.

Kentucky car tax is 240150 at 600 based on an amount of 40025 combined from the sale price of 39750 plus the doc fee of 475 plus the extended warranty cost of 3500 minus the trade-in value of 2200 minus the rebate of 1500. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Real estate in Kentucky is typically assessed through a mass appraisal.

Our calculator has been specially developed in order to provide the users of the calculator with not only. Vehicle has a branded or rebuilt title. Will also add 12 interest compounded monthly to unpaid taxes Monday December 13th from 5 pm.

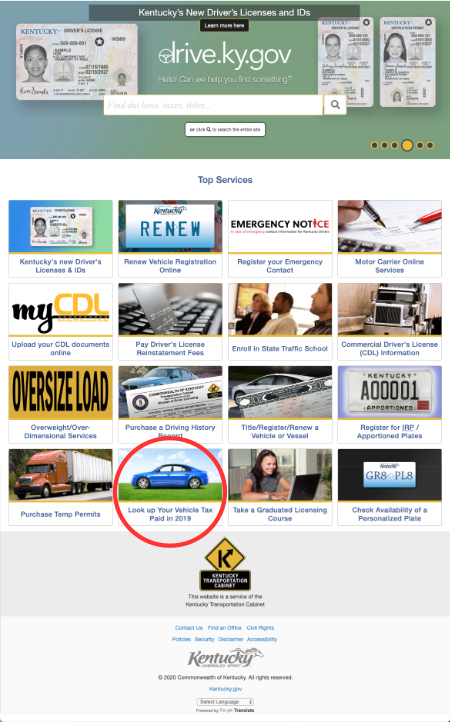

If you make 70000 a year living in the region of Kentucky USA you will be taxed 11753. It is levied at six percent and shall be paid on every motor vehicle used in Kentucky. Web Search tax data by vehicle identification number for the year 2021.

For most counties and cities in the Bluegrass State this is a percentage of taxpayers. Kentucky Capital Gains Tax. Aside from state and federal taxes many Kentucky residents are subject to local taxes which are called occupational taxes.

Web To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county. The tax rate is the same no matter what filing status you use. Vehicle value includes options which customers vehicle does not contain.

Web You are able to use our Kentucky State Tax Calculator to calculate your total tax costs in the tax year 202223. Please contact them at 502 564-5301 or. Kentucky has a 6 statewide sales tax rate but also has 212 local tax jurisdictions.

1 of each year. Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates. In the case of new vehicles the retail price is the total consideration given The consideration is the total of the cash or amount financed and the value of any vehicle traded in or 90 of the manufacturers suggested retail price.

Once you have the tax rate multiply it with the vehicles purchase price. The percentage paid is labled a Usage Tax Get more info on our car tax page. You can do this on your own or use an online tax calculator.

Web Overview of Kentucky Taxes. Average Local State Sales Tax. Where can I find my Vehicle Identification Number VIN.

Thats the assessment date for all property in the state so taxes are based on the value of the property as of Jan. KRS 132220 1 a. The Kentucky Transportation Cabinet is responsible for all title and watercraft related issues.

You can find the VIN. Please note that this is an estimated amount. In 2018 Kentucky legislators raised the cigarette tax by 50 cents bringing it up to 110 per pack of 20.

For example imagine you are purchasing a vehicle for 45000 with the state sales tax of 6. The non-refundable online renewal service fee is a percentage of the transaction total and is assessed to develop and maintain the Online Kentucky Vehicle Registration Renewal Portal. Web Kentucky Property Tax Rules.

Please allow 5-7 working days for online renewals to be processed. Property Valuation Administrators PVAs in each county must list value and assess the property tax on motor vehicles and motor boats as of January 1st of each year. Web Kentucky Income Tax Calculator 2021.

Kentucky Department of Revenue. The tax estimator above only includes a single 75 service fee. Kentucky imposes a flat income tax of 5.

Email Send us a message. These fees are separate from the sales tax and will likely be collected by the Kentucky Department of Motor Vehicles and not the Kentucky Department of Revenue. Web Maximum Possible Sales Tax.

Web Vehicle has been wrecked and damage has not been repaired prior to assessment date January 1.

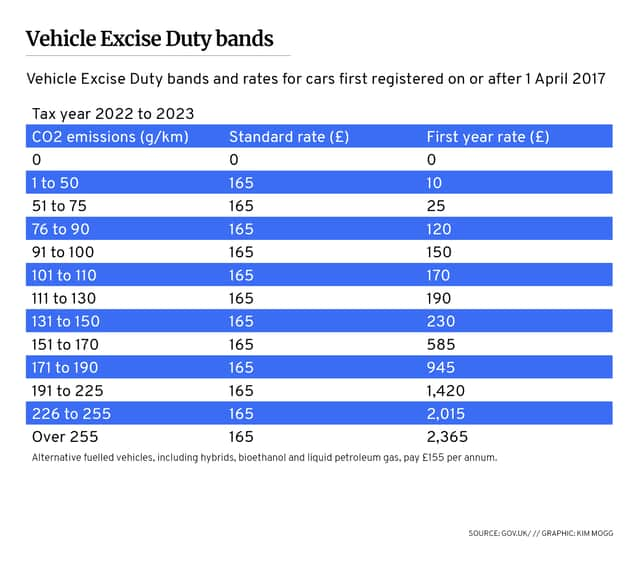

Car Tax Disc Changes Five Facts You Never Knew About Your Almost Obsolete Tax Disc The Independent The Independent

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

This Is How Much Drivers Will Pay In Car Taxes From 1 April Nationalworld

This Is How Much Drivers Will Pay In Car Taxes From 1 April Nationalworld

Car Tax By State Usa Manual Car Sales Tax Calculator

How To Appeal Kentucky Car Tax Value Assessment Whas11 Com

Motor Vehicle Taxes Department Of Revenue

Car Tax By State Usa Manual Car Sales Tax Calculator

The States With The Lowest Car Tax The Motley Fool

Nj Car Sales Tax Everything You Need To Know

Dmv Fees By State Usa Manual Car Registration Calculator

Get Reliable Transportation Solutions For The Long Haul Transportation Solutions Tax Return Trucking Companies

South Carolina Sales Tax On Cars Everything You Need To Know

Ky To Halt Rising Vehicle Property Taxes Governor Proposes Temporary Sales Tax Reduction Wchs

What S The Car Sales Tax In Each State Find The Best Car Price

2020 Vehicle Tax Information Jefferson County Clerk Bobbie Holsclaw

Kentucky House Votes To Give Relief On Vehicle Tax Bills Span Class Tnt Section Tag No Link News Span Wpsd Local 6

Microsoft Excel Templates Auto Mileage Log Template Microsoft Excel Templates 10f743a2 Resumesample Resumefor Excel Templates Templates Book Template