do you pay taxes on a leased car in texas

What is the motor vehicle tax rate. Trade Difference 20000.

Consider Selling Your Car Before Your Lease Ends Edmunds

Texas does exempt leased vehicles that are not held for the primary purpose of income production by the lessee.

. Technically there are two separate transactions and Texas taxes it that way. Howeverm i did fill out a 50-285 affidavit and submitted with my lease paperwork. I leased a vehicle at the end of 2019.

This means you only pay tax on the part of the car you lease not the entire value of the car. The most common method is to tax monthly lease payments at the local sales tax rate. While most people dont have to pay taxes on a rented property thats not the case with leased vehicles.

You will have to pay taxes on your leased car each year that you have it. Texas does not tax leases. A car lease acquisition cost is a fee charged by the lessor to set up the lease.

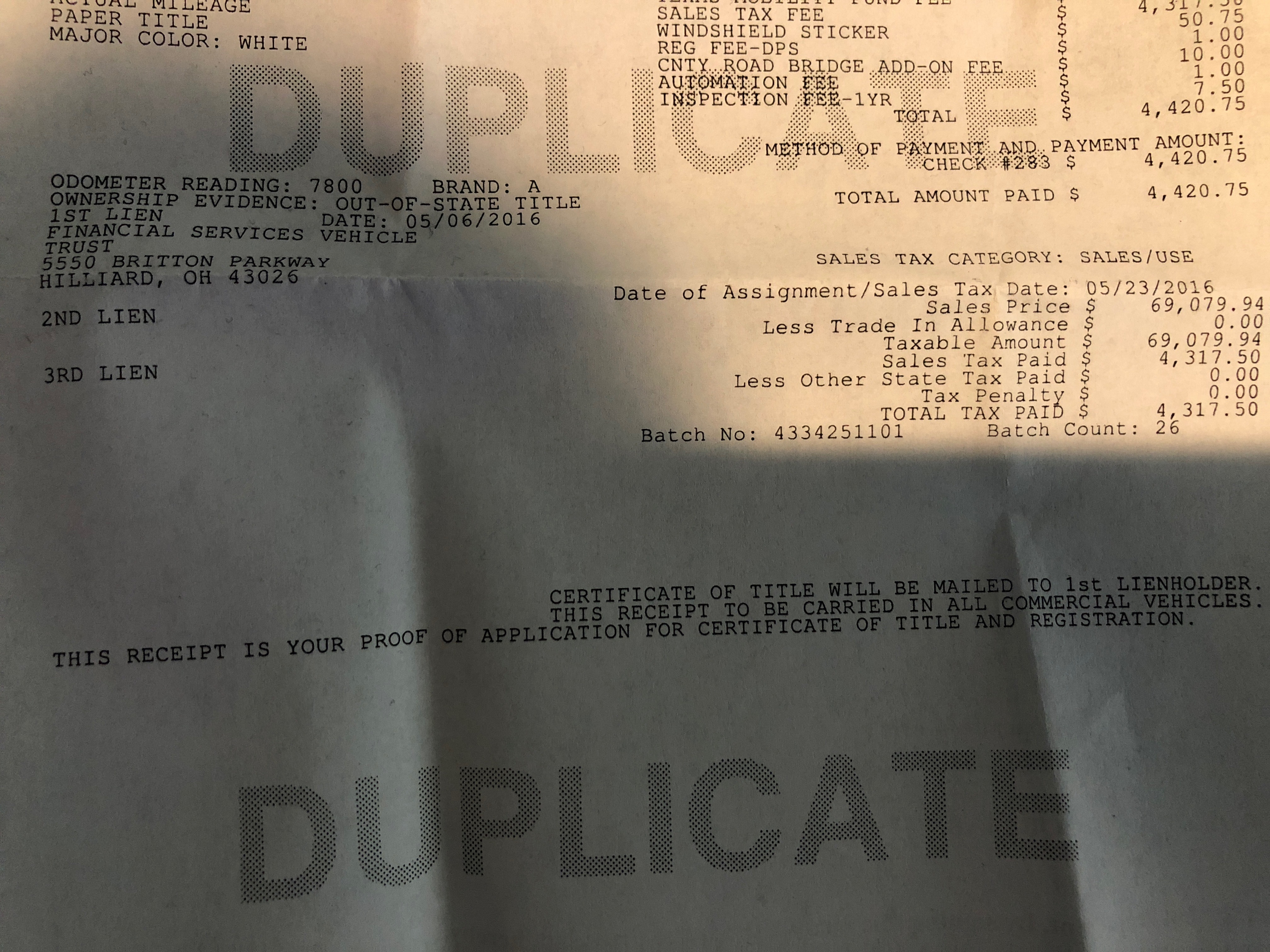

Texas residents 625 percent of sales price less credit for. The rate is 625 percent and is calculated on the purchase price of the vehicle. In the state of Texas you pay 625 tax on Trade difference.

In car leasing how the sales tax is calculated and when it needs to be. Six dollars is due to the lessor. The taxable value of private.

Do you pay taxes on a leased car. In the state of Texas any leases lasting for greater than one hundred and eighty days are considered to be exempt from the general sales and use tax but will be subject to any. The taxable value of private-party purchases of used motor vehicles may be based on the standard presumptive value.

Its sometimes called a bank fee lease inception fee or. Car youre trading 30000. Didnt receive a tax bill for that year.

How much is property tax on a vehicle in Texas. Acquisition Fee Bank Fee. Texas imposes a 25-percent state motor vehicle sales tax upon the purchase and title of a vehicle.

Yes in Texas you must pay tax again when you buy your off-lease vehicle. These vehicles include passenger cars or trucks with a. In most states both car purchases and leases are subject to sales tax.

Car youre buying 50000.

Leasing A Car And Moving To Another State What To Know And What To Do

What S The Car Sales Tax In Each State Find The Best Car Price

Lease Assumption In Texas From An Out Of State Lease Taxes Ask The Hackrs Forum Leasehackr

What Questions You Should Ask About Your Lease Nbc 5 Dallas Fort Worth

Leasing A Car What Fees Do You Pay At The Start Of A Lease Autotrader

Is It Better To Buy Or Lease A Car Taxact Blog

Nj Car Sales Tax Everything You Need To Know

/when-leasing-car-better-buying.asp_final-10bbb582c2f74c2b9c4eafcc6fbab0bd.png)

Pros And Cons Of Leasing Or Buying A Car

Leasing A Car And Moving To Another State What To Know And What To Do

Is It Better To Buy Or Lease A Car Taxact Blog

Tax On Leased Bmw In Texas Lessee S Affidavit For Motor Vehicle Use Other Than Production Of Income Ask The Hackrs Forum Leasehackr

Can Taxes Paid On A Leased Vehicle Be Written Off On Federal Taxes

Is Your Car Lease A Tax Write Off A Guide For Freelancers

Do You Pay Sales Tax On A Lease Buyout

The Fees And Taxes Involved In Car Leasing Complete Guide

Will I Pay Sales Tax When Buying My Leased Car Fox Business

Do Auto Lease Payments Include Sales Tax

Texas Car Sales Tax Everything You Need To Know

Refinancing A Leased Car The Complete Guide For 2019 Protect My Car